import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from pandas_datareader import data

import datetime as dt

from statsmodels.graphics.tsaplots import plot_acf

from statsmodels.graphics.tsaplots import pacf as pacf_func

from statsmodels.graphics.tsaplots import acf as acf_func

import statsmodels.graphics.tsaplots as tsa

from statsmodels.graphics.tsaplots import plot_pacf

from statsmodels.tsa.arima_process import ArmaProcess

from statsmodels.tsa.arima.model import ARIMA

import pmdarima as pm

plt.style.use("ggplot")

import warnings

warnings.filterwarnings("ignore")Though the Autoregressive model rarely plays a role in practice, joined with Moving Average model they undoubted are the foundation of advanced techniques. Here is the standard form of \(\text{AR(1)}\) \[ \text{AR(1)}: \qquad Y_{t}=\phi_0+\phi_{1} Y_{t-1}+u_{t} \] If \(\phi_1<1\), the series exhibits mean-reversion feature, and \(\phi_1>1\) exhibits trend-following feature.

As a reminder for statsmodels, ArmaProcess object needs zero lag coefficient to be \(1\) explicitly input and the signs from lag \(1\) onward also must be reversed, e.g. plus sign reversed to minus.

Features of AR

We have shown that as long as the eigenvalues, all the \(\lambda\)’s of the AR system stay within unit modulus, the system will be stable.

Now take expectation of a stationary \(\text{AR(1)}\) \[ E\left(Y_t\right)=\phi_0+\phi_1 \cdot E\left(Y_{t-1}\right)+E\left(u_t\right)\quad \longrightarrow \quad \mu=\phi_0+\phi_1 \cdot \mu \quad \longrightarrow \quad \mu= \frac{\phi_0}{1-\phi_1} \]

To derive the variance of \(\text{AR(1)}\), we need some extra work.

To simplify the derivation, we use a \(\text{AR(1)}\) without a constant, then demean it

\[ \left(Y_t-\mu\right)=\phi\left(Y_{t-1}-\mu\right)+u_t\tag{1} \]

Take square, then expectation on both sides of \((1)\) \[ E\left(Y_t-\mu\right)^2=\phi^2 E\left(Y_{t-1}-\mu\right)^2+2 \phi E\left[\left(Y_{t-1}-\mu\right) u_t\right]+E\left(u_t^2\right) \]

The second term \(2 \phi E\left[\left(Y_{t-1}-\mu\right) u_t\right]\) will be \(0\).

Assume \(E\left(Y_t-\mu\right)^2=E\left(Y_{t-1}-\mu\right)^2=\gamma_0\), \(\gamma_0\) represents autocovariance at \(0\) lag, i.e. variance, therefore the expression tells the covariance stationarity.

We obtain the final expression of variance \[ \gamma_0=\sigma^2 /\left(1-\phi^2\right) \]

To derive a general expression of autocovaraince, multiply \(\left(Y_{t-j}-\mu\right)\) on both sides of \((1)\)

\[ \begin{aligned} E\left[\left(Y_t-\mu\right)\left(Y_{t-j}-\mu\right)\right]=\phi\cdot E\left[\left(Y_{t-1}-\mu\right)\left(Y_{t-j}-\mu\right)\right]+E\left[\varepsilon_t\left(Y_{t-j}-\mu\right)\right] \end{aligned} \]

By assuming \(E\left[\varepsilon_t\left(Y_{t-j}-\mu\right)\right]\), we obtain \[ \gamma_j=\phi \gamma_{j-1} \]

The solution of difference equation is \[ \gamma_j=\phi^j \gamma_0 \longrightarrow \rho_{j} = \frac{\gamma_{j}}{\gamma_{0}} =\phi^j \]

We have just shown that in \(\text{AR(1)}\) model, dynamic multiplier equals autocorrelation!

As for \(\text{AR}(p)\) model, similar results can be achieved, also start from a demeaned \(\text{AR}(p)\). \[ \begin{aligned} Y_t-\mu=\phi_1\left(Y_{t-1}-\mu\right)+\phi_2\left(Y_{t-2}-\mu\right)+\cdots+\phi_p\left(Y_{t-p}-\mu\right)+u_t \end{aligned} \]

Multiply both sides by \(\left(Y_{t-j}-\mu\right)\), take expectations \[ \gamma_j=\phi_1 \gamma_{j-1}+\phi_2 \gamma_{j-2}+\cdots+\phi_p \gamma_{j-p} \quad \text { for } j=1,2, \ldots \]

Dividing this equation by \(\gamma_0\) produces the famous Yule-Walk Equation, which is an alternative method of computing ACF.

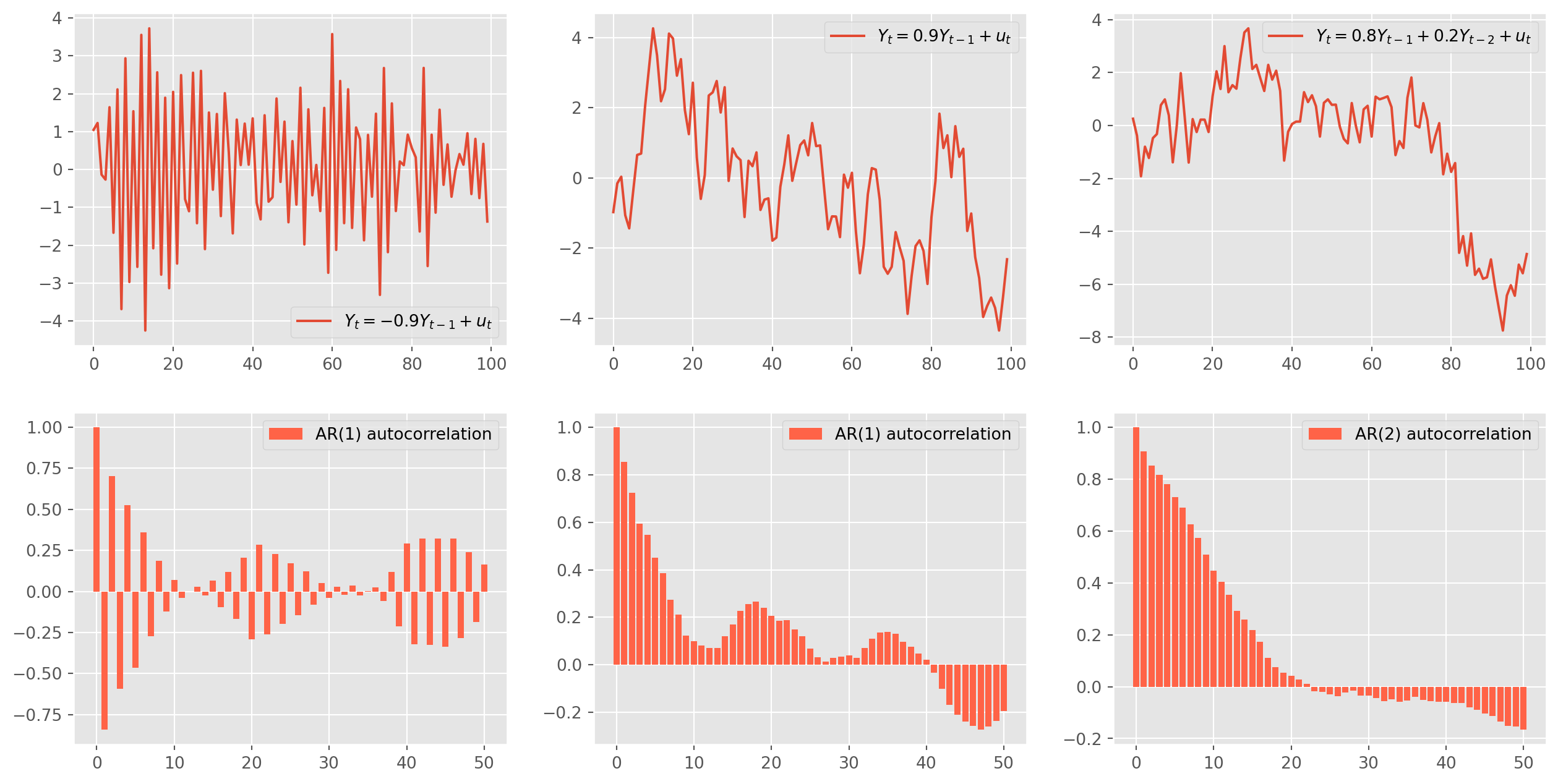

AR Simulation

Codes below generate \(\text{AR}\) series by specifying parameters. The guidance are written as comments along the codes.

ar_params = np.array([1, 0.9]) # alwasy specify zero lag as 1

ma_params = np.array([1]) # alwasy specify zero lag as 1

ar1 = ArmaProcess(ar_params, ma_params) # the Class requires AR and MA's parameters

ar1_sim = ar1.generate_sample(nsample=100)

ar1_sim = pd.DataFrame(ar1_sim, columns=["AR(1)"])

ar1_acf = acf_func(ar1_sim.values, fft=False, nlags=50) # return the numerical ACF

ar_params1 = np.array([1, -0.9])

ma_params1 = np.array([1])

ar1_pos = ArmaProcess(ar_params1, ma_params1)

ar1_sim_pos = ar1_pos.generate_sample(nsample=100)

ar1_sim_pos = pd.DataFrame(ar1_sim_pos, columns=["AR(1)"])

ar1_acf_pos = acf_func(ar1_sim_pos.values, fft=False, nlags=50)

ar_params2 = np.array([1, -0.8, -0.2])

ma_params2 = np.array([1])

ar2 = ArmaProcess(ar_params2, ma_params2)

ar2_sim = ar2.generate_sample(nsample=100)

ar2_sim = pd.DataFrame(ar2_sim, columns=["AR(2)"])

ar2_acf = acf_func(ar2_sim.values, fft=False, nlags=50)fig, ax = plt.subplots(figsize=(16, 8), nrows=2, ncols=3)

ax[0, 0].plot(ar1_sim, label="$Y_t = {%s}Y_{t-1}+u_t$" % (-ar_params[1]))

ax[0, 0].legend()

ax[1, 0].bar(

np.arange(len(ar1_acf)), ar1_acf, color="tomato", label="AR(1) autocorrelation"

)

ax[1, 0].legend()

ax[0, 1].plot(ar1_sim_pos, label="$Y_t = {%s}Y_{t-1}+u_t$" % (-ar_params1[1]))

ax[0, 1].legend()

ax[1, 1].bar(

np.arange(len(ar1_acf_pos)),

ar1_acf_pos,

color="tomato",

label="AR(1) autocorrelation",

)

ax[1, 1].legend()

ax[0, 2].plot(

ar2_sim,

label="$Y_t = {%s} Y_{t-1}+{%s} Y_{t-2}+u_t$" % (-ar_params2[1], -ar_params2[2]),

)

ax[0, 2].legend()

ax[1, 2].bar(

np.arange(len(ar2_acf)), ar2_acf, color="tomato", label="AR(2) autocorrelation"

)

ax[1, 2].legend()

plt.show()Mechanism of Simulation

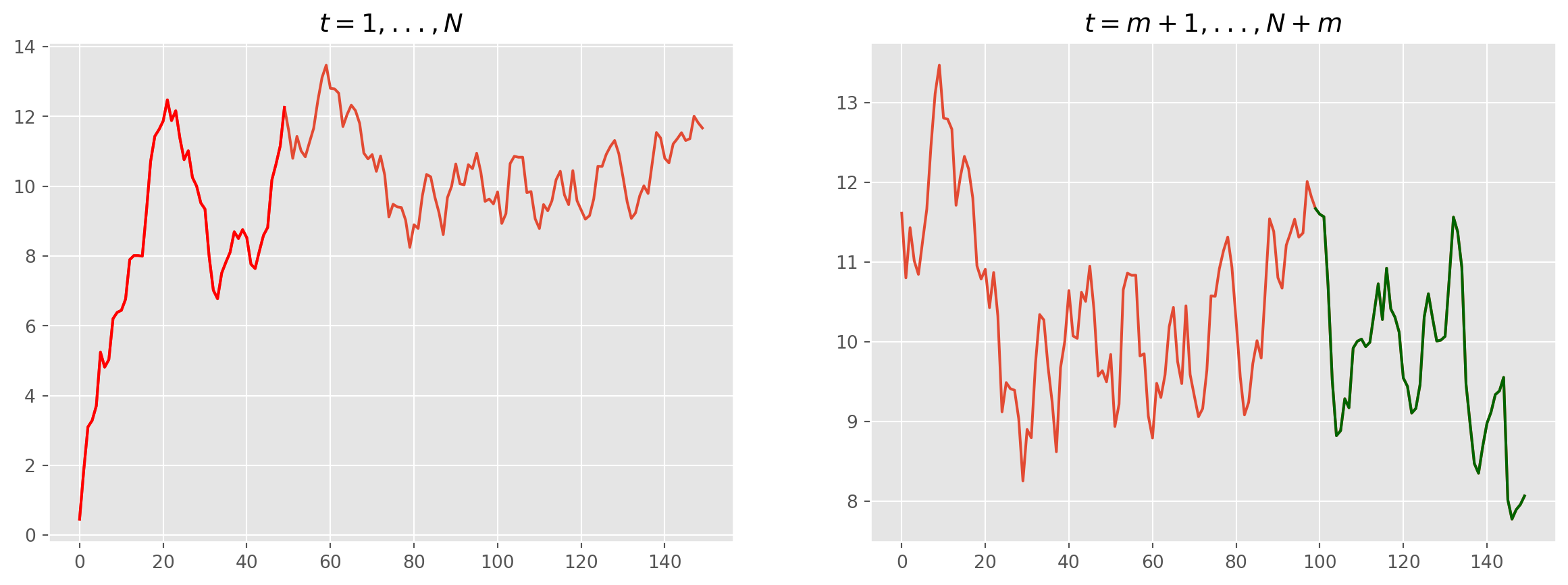

np.random.seed(123)

#

m = 50

N = 150

epsilon = np.random.normal(loc=0, scale=0.5, size=N + m)

#

temp = np.array(1 + epsilon[0], ndmin=1)

temp = np.append(temp, 1 + 0.8 * temp[0] + epsilon[1])for j in range(2, N + m):

Y_temp = 1 + 1.1 * temp[j - 1] - 0.2 * temp[j - 2] + epsilon[j]

temp = np.append(temp, Y_temp)

#fig, ax = plt.subplots(figsize=(15, 5), nrows=1, ncols=2)

ax[0].plot(temp[:N])

ax[0].plot(list(range(0, m)), temp[:m], color="red")

ax[0].set_title("$t = 1, ..., N$")

ax[1].plot(temp[m:])

ax[1].plot(list(range(N - m - 1, N)), temp[(N - 1) :], color="darkgreen")

ax[1].set_title("$t = m + 1,..., N+m$")

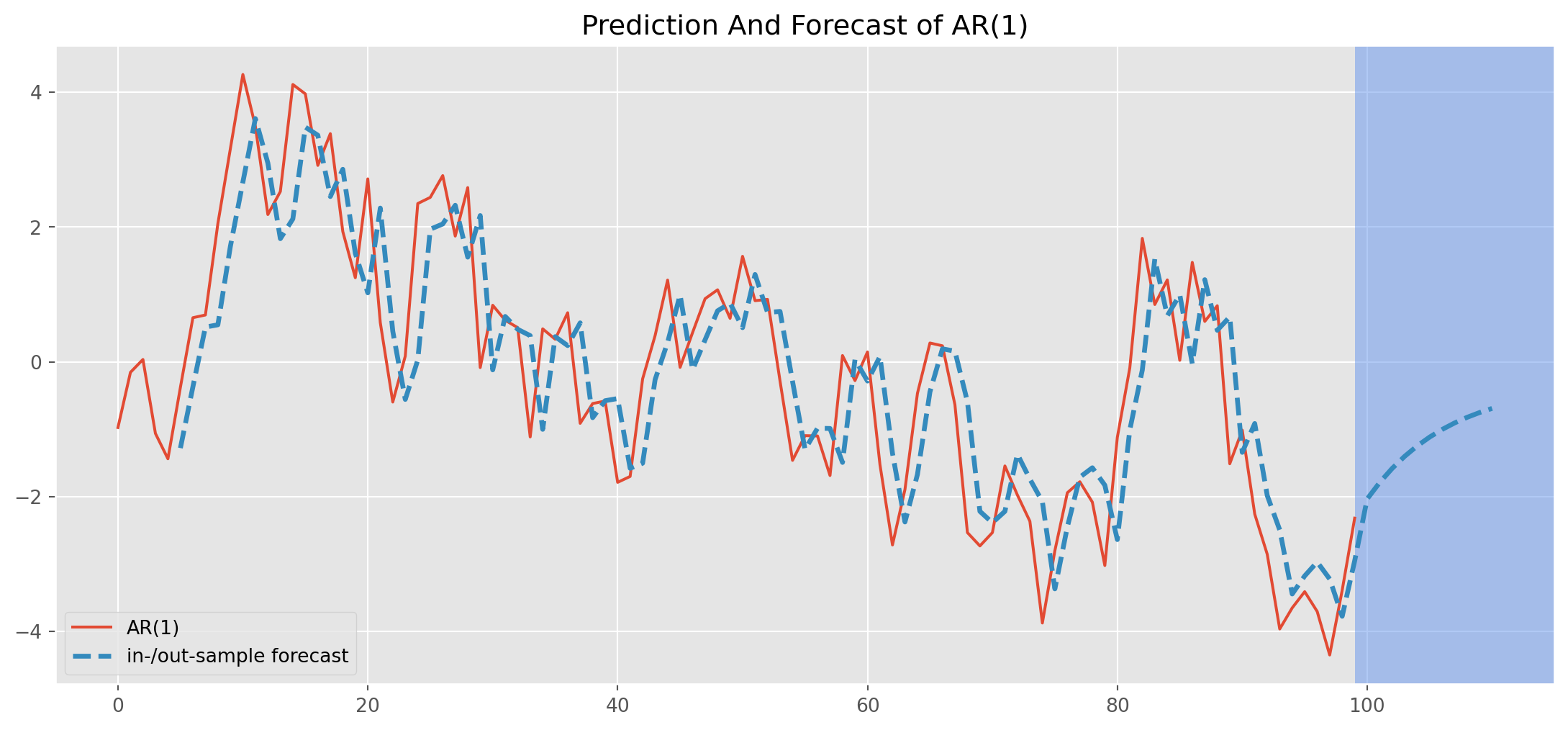

plt.show()Estimation and Forecast of AR(1)

The estimation can be achieved by instantiating an object from ARIMA class. As you can see the class requires specifying the order for \(\text{ARIMA}\) model, where \(\text{I}\) means integrated, i.e. order of difference to render stationary.

For instance, \(\text{AR(1)}\) with \(1st\) order stationary series can also be written as \(\text{ARIMA(1, 0, 0)}\).

Output sigma2 is the variance of residuals \(\sigma^2\).

This is the model we are estimating \[ Y_{t}=\phi_0+\phi_{1} Y_{t-1}+u_{t} \]

mod_obj = ARIMA(ar1_sim_pos, order=(1, 0, 0)) # input the order for ARIMA

result = mod_obj.fit()

print(result.summary()) SARIMAX Results

==============================================================================

Dep. Variable: AR(1) No. Observations: 100

Model: ARIMA(1, 0, 0) Log Likelihood -142.944

Date: Sun, 27 Oct 2024 AIC 291.889

Time: 17:40:04 BIC 299.704

Sample: 0 HQIC 295.052

- 100

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.3229 0.724 -0.446 0.656 -1.742 1.096

ar.L1 0.8574 0.055 15.468 0.000 0.749 0.966

sigma2 1.0077 0.169 5.963 0.000 0.677 1.339

===================================================================================

Ljung-Box (L1) (Q): 0.00 Jarque-Bera (JB): 1.43

Prob(Q): 0.95 Prob(JB): 0.49

Heteroskedasticity (H): 0.90 Skew: -0.06

Prob(H) (two-sided): 0.76 Kurtosis: 2.43

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).res_predict = result.predict(start=5, end=110)Plot both the simulated \(\text{AR(1)}\) and the forecast/predicted series.

ar1_sim_pos.plot(figsize=(14, 6), label="simulated AR(1) series")

res_predict.plot(

label="in-/out-sample forecast",

title="Prediction And Forecast of AR(1)",

ls="--",

lw=2.5,

)

plt.axvspan(

len(ar1_sim_pos) - 1, len(ar1_sim_pos) + 15, alpha=0.5, lw=0, color="CornflowerBlue"

)

plt.xlim([-5, 115])

plt.legend()

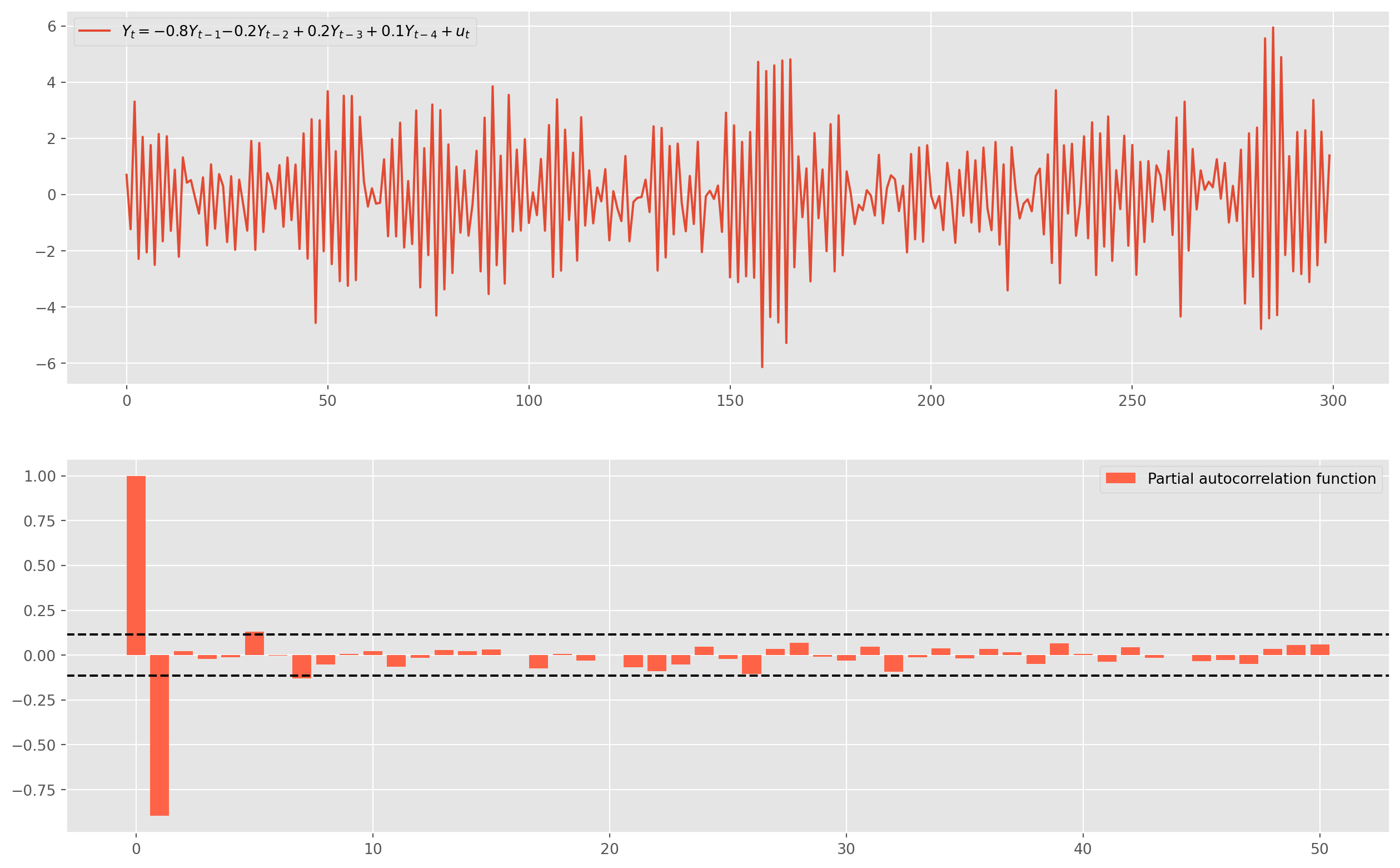

plt.show()Identification of the Order of an AR Model

The usual practice of order identification is called the Box-Jenkins Methodology, which will be explicated below, for now we simply perform two techniques: 1. Partial Autocorrelation Function 2. Akaike or Bayesian Information Criteria (\(\text{AIC}\), \(\text{BIC}\))

First, we will simulate a series, the true data generating process is given by \(\text{AR(4)}\) \[ Y_{t}=-0.8 Y_{t-1}-0.2 Y_{t-2}+0.2Y_{t-3}+0.1Y_{t-4}+u_{t} \]

obs = 300

ar_params = np.array([1, 0.8, 0.2, -0.2, -0.1])

ma_params = np.array([1])

ar4 = ArmaProcess(ar_params, ma_params)

ar4_sim = ar1.generate_sample(nsample=obs)

ar4_sim = pd.DataFrame(ar4_sim, columns=["AR(4)"])

ar4_pacf = pacf_func(ar4_sim.values, nlags=50)

fig, ax = plt.subplots(figsize=(16, 10), nrows=2, ncols=1)

ax[0].plot(

ar4_sim,

label="$Y_t = {%s}Y_{t-1} {%s}Y_{t-2} +{%s}Y_{t-3} +{%s}Y_{t-4}+u_t$"

% (-ar_params[1], -ar_params[2], -ar_params[3], -ar_params[4]),

)

ax[0].legend()

ax[1].bar(

np.arange(len(ar4_pacf)),

ar4_pacf,

color="tomato",

label="Partial autocorrelation function",

)

ax[1].axhline(y=2 / np.sqrt(obs), linestyle="--", color="k")

ax[1].axhline(y=-2 / np.sqrt(obs), linestyle="--", color="k")

ax[1].legend()

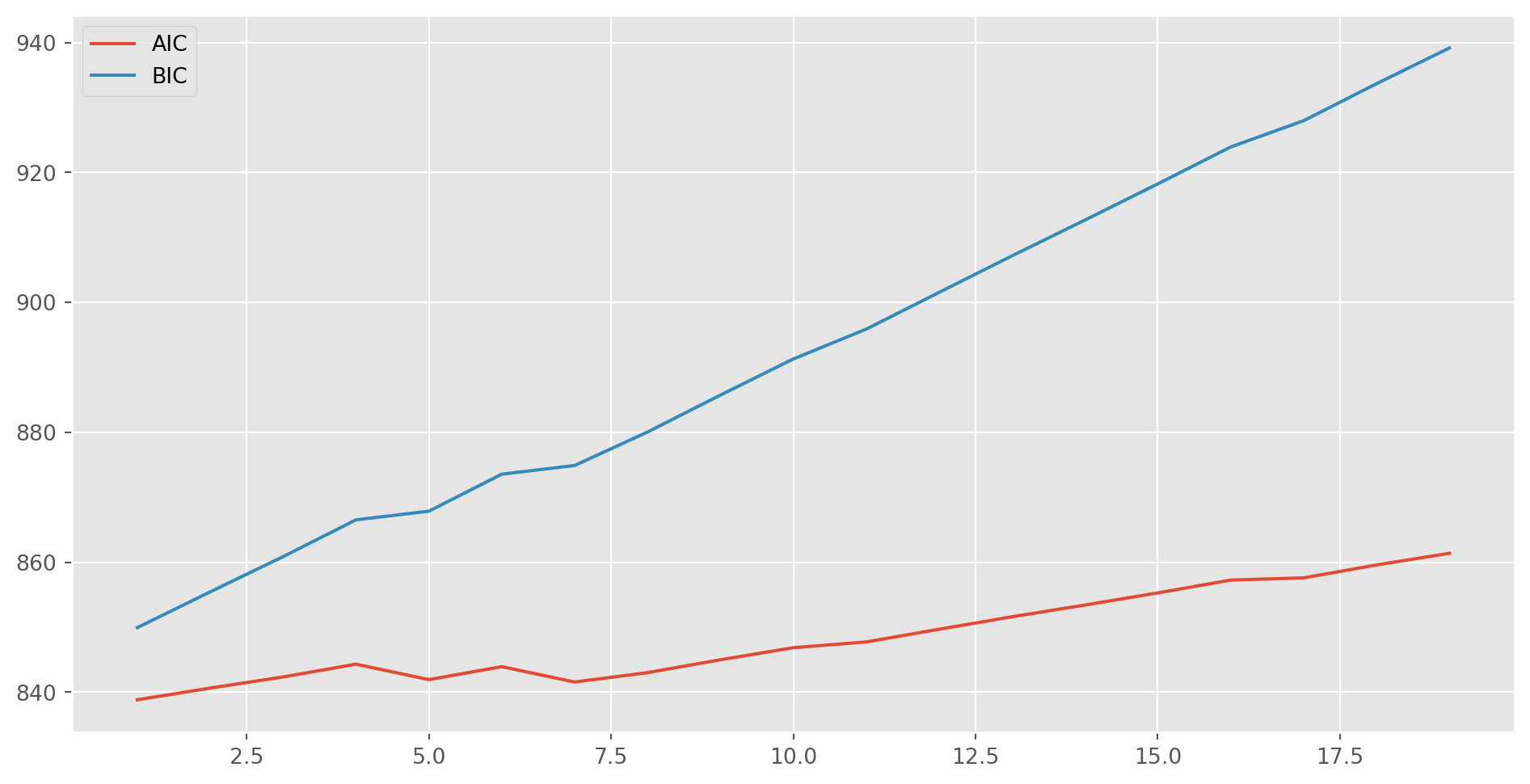

plt.show()Only lag \(1\) is significant in PACF, which suggests we could estimate the series with \(\text{AR(1)}\). However, we could also identify the lags by using \(\text{AIC}\) and \(\text{BIC}\).

The basic notion is to compare competing models and choose the one with lowest \(\text{BIC}\) or \(\text{AIC}\). You don’t need to use both of them, I personally prefer to \(\text{BIC}\).

aic, bic = [], []

max_lag = 20

for i in range(max_lag): # compare max_lag lags

mod_obj = ARIMA(ar4_sim, order=(i, 0, 0))

result = mod_obj.fit()

aic.append(result.aic)

bic.append(result.bic)fig, ax = plt.subplots(figsize=(12, 6))

ax.plot(range(1, max_lag), aic[1:max_lag], label="AIC")

ax.plot(range(1, max_lag), bic[1:max_lag], label="BIC")

ax.legend()

plt.show()In this case, an \(\text{AR(1)}\) model would be fair good fit. Then we fit it.

mod_obj = ARIMA(ar4_sim, order=(1, 0, 0))

result = mod_obj.fit()

print(result.summary()) SARIMAX Results

==============================================================================

Dep. Variable: AR(4) No. Observations: 300

Model: ARIMA(1, 0, 0) Log Likelihood -416.415

Date: Sun, 27 Oct 2024 AIC 838.830

Time: 17:40:11 BIC 849.941

Sample: 0 HQIC 843.276

- 300

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0364 0.030 -1.226 0.220 -0.095 0.022

ar.L1 -0.8899 0.024 -36.820 0.000 -0.937 -0.843

sigma2 0.9352 0.080 11.636 0.000 0.778 1.093

===================================================================================

Ljung-Box (L1) (Q): 0.12 Jarque-Bera (JB): 0.54

Prob(Q): 0.73 Prob(JB): 0.76

Heteroskedasticity (H): 1.17 Skew: 0.04

Prob(H) (two-sided): 0.44 Kurtosis: 2.81

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).MA Model

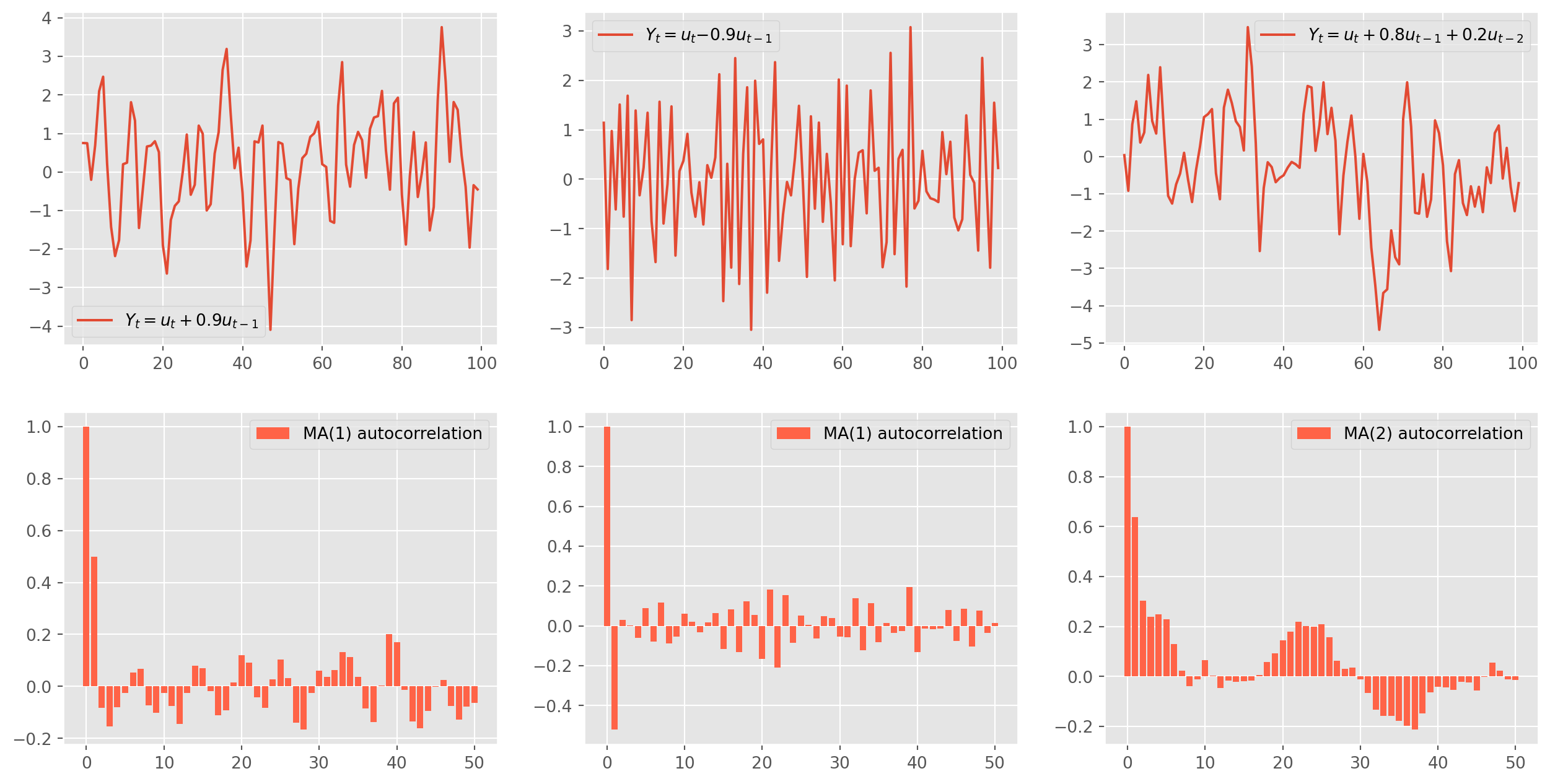

The Moving Average model is the missing part of workhorse \(\text{ARIMA}\). Here is an \(\text{MA(1)}\) model \[ Y_{t}= u_{t}+\theta_{1} u_{t-1} \] And the codes for generating \(\text{MA}\) series are similar to \(\text{AR}\). The plots are for your references.

ar_params = np.array([1])

ma_params = np.array([1, 0.9])

ma1 = ArmaProcess(ar_params, ma_params)

ma1_sim = ma1.generate_sample(nsample=100)

ma1_sim = pd.DataFrame(ma1_sim, columns=["MA(1)"])

ma1_acf = acf_func(ma1_sim.values, fft=False, nlags=50)

ar_params1 = np.array([1])

ma_params1 = np.array([1, -0.9])

ma1_neg = ArmaProcess(ar_params1, ma_params1)

ma1_sim_neg = ma1_neg.generate_sample(nsample=100)

ma1_sim_neg = pd.DataFrame(ma1_sim_neg, columns=["MA(1)"])

ma1_acf_neg = acf_func(ma1_sim_neg.values, fft=False, nlags=50)

ar_params2 = np.array([1])

ma_params2 = np.array([1, 0.8, 0.2])

ma2 = ArmaProcess(ar_params2, ma_params2)

ma2_sim = ma2.generate_sample(nsample=100)

ma2_sim = pd.DataFrame(ma2_sim, columns=["MA(2)"])

ma2_acf = acf_func(ma2_sim.values, fft=False, nlags=50)fig, ax = plt.subplots(figsize=(16, 8), nrows=2, ncols=3)

ax[0, 0].plot(ma1_sim, label="$Y_t = u_t + {%s} u_{t-1}$" % (ma_params[1]))

ax[0, 0].legend()

ax[1, 0].bar(

np.arange(len(ma1_acf)), ma1_acf, color="tomato", label="MA(1) autocorrelation"

)

ax[1, 0].legend()

ax[0, 1].plot(ma1_sim_neg, label="$Y_t = u_t {%s} u_{t-1}$" % (ma_params1[1]))

ax[0, 1].legend()

ax[1, 1].bar(

np.arange(len(ma1_acf_neg)),

ma1_acf_neg,

color="tomato",

label="MA(1) autocorrelation",

)

ax[1, 1].legend()

ax[0, 2].plot(

ma2_sim,

label="$Y_t = u_t +{%s} u_{t-1}+ {%s} u_{t-2} $"

% (ma_params2[1], ma_params2[2]),

)

ax[0, 2].legend()

ax[1, 2].bar(

np.arange(len(ma2_acf)), ma2_acf, color="tomato", label="MA(2) autocorrelation"

)

ax[1, 2].legend()

plt.show()Features of MA

An \(\text{MA(1)}\) process with constant term \(\mu\), takes the form \[ Y_{t}=\mu + u_{t}+\theta u_{t-1},\qquad u_t\sim N(0, \sigma^2) \]

Take expectation \[ E(Y_{t})= E(\mu+u_{t}+\theta u_{t-1}) = E(\mu)+E(u_{t})+\theta E(u_{t-1}) = \mu \] The \(\mu\) is the mean of \(Y_t\).

If the MA process doesn’t have a constant, the expectation will be \(0\).

The variance of \(\text{MA(1)}\) \[ \begin{aligned} E\left(Y_t-\mu\right)^2 &=E\left(u_t+\theta u_{t-1}\right)^2 \\ &=E\left(u_t^2+2 \theta u_t u_{t-1}+\theta^2 u_{t-1}^2\right) \\ &=\sigma^2+0+\theta^2 \sigma^2 \\ &=\left(1+\theta^2\right) \sigma^2 \end{aligned} \]

Thus an \(\text{MA(1)}\) process is always a (weak) stationary process.

Similarly, the general case of a \(\text{MA}(q)\) process \[ Y_t=\mu+u_t+\theta_1 u_{t-1}+\theta_2 u_{t-2}+\cdots+\theta_q u_{t-q} \]

The mean is given by \[ E(Y_t)=E(\mu)+E(u_t)+\theta_1 E( u_{t-1})+\theta_2 E( u_{t-2})+\cdots+\theta_q E( u_{t-q})=\mu \] And the variance is given by \[ E\left(Y_t-\mu\right)^2=E\left(u_t+\theta_1 u_{t-1}+\theta_2 u_{t-2}+\cdots+\theta_q u_{t-q}\right)^2 \] Since \(u\)’s are uncorrelated, there won’t be any cross terms in the variance \[ E\left(Y_t-\mu\right)^2=\sigma^2+\theta_1^2 \sigma^2+\theta_2^2 \sigma^2+\cdots+\theta_q^2 \sigma^2=\left(1+\theta_1^2+\theta_2^2+\cdots+\theta_q^2\right) \sigma^2 \] Thus an \(\text{MA}(q)\) process is always a (weak) stationary process.

As for autocovariance \(\gamma_k\) \[\begin{aligned} \text{Cov}(Y_t , Y_{t-k})=\gamma_j=& E\left[\left(u_t+\theta_1 u_{t-1}+\theta_2 u_{t-2}+\cdots+\theta_q u_{t-q}\right)\right.\\ &\left.\times\left(u_{t-k}+\theta_1 u_{t-k-1}+\theta_2 u_{t-k-2}+\cdots+\theta_q u_{t-k-q}\right)\right] \\ =& E\left[\theta_k u_{t-k}^2+\theta_{k+1} \theta_1 u_{t-k-1}^2+\theta_{k+2} \theta_2 u_{t-k-2}^2+\cdots+\theta_q \theta_{q-k} u_{t-q}^2\right] \end{aligned}\]To summarize, \[ \gamma_j=\left\{\begin{array}{l} {\left[\theta_k+\theta_{k+1} \theta_1+\theta_{k+2} \theta_2+\cdots+\theta_q \theta_{q-k}\right] \cdot \sigma^2}\qquad j=1,2,...,q \\ 0\qquad j>q \end{array}\right. \] which mean ACF of \(\text{MA}(q)\) after \(q\) lags is zero.

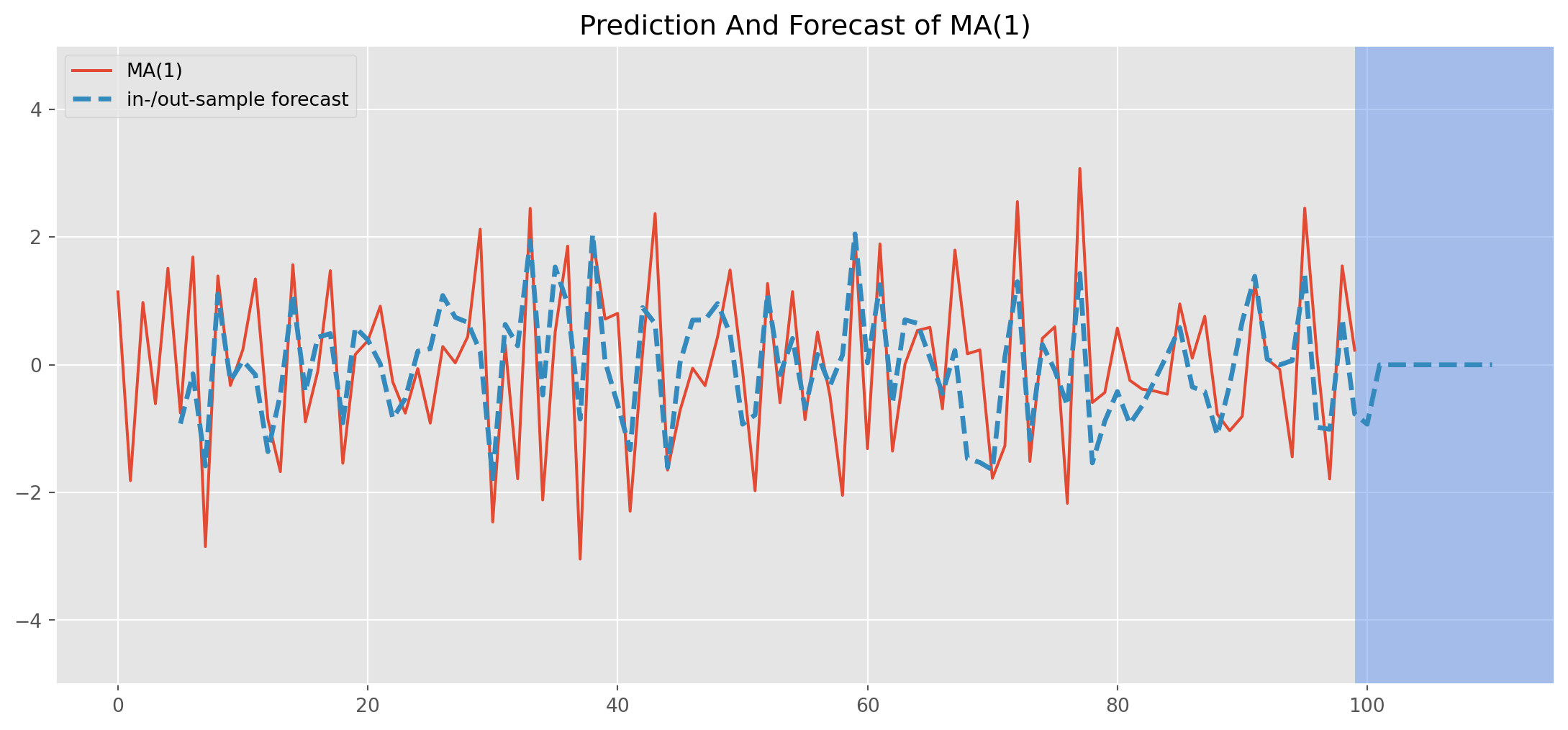

Estimation and Forecast of MA

Estimate the series generated by true relationship \[ Y_{t}= u_{t}-0.9 u_{t-1} \]

mod_obj = ARIMA(ma1_sim_neg, order=(0, 0, 1))

result = mod_obj.fit()

print(result.summary()) SARIMAX Results

==============================================================================

Dep. Variable: MA(1) No. Observations: 100

Model: ARIMA(0, 0, 1) Log Likelihood -137.433

Date: Sun, 27 Oct 2024 AIC 280.866

Time: 17:40:12 BIC 288.682

Sample: 0 HQIC 284.029

- 100

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0012 0.008 -0.150 0.881 -0.017 0.014

ma.L1 -0.9331 0.048 -19.482 0.000 -1.027 -0.839

sigma2 0.8961 0.148 6.041 0.000 0.605 1.187

===================================================================================

Ljung-Box (L1) (Q): 0.17 Jarque-Bera (JB): 1.26

Prob(Q): 0.68 Prob(JB): 0.53

Heteroskedasticity (H): 1.21 Skew: -0.09

Prob(H) (two-sided): 0.59 Kurtosis: 2.48

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).res_predict = result.predict(start=5, end=110)ma1_sim_neg.plot(figsize=(14, 6))

res_predict.plot(

label="in-/out-sample forecast",

title="Prediction And Forecast of MA(1)",

ls="--",

lw=2.5,

)

plt.axvspan(

len(ar1_sim_pos) - 1, len(ar1_sim_pos) + 15, alpha=0.5, lw=0, color="CornflowerBlue"

)

plt.xlim([-5, 115])

plt.ylim([-5, 5])

plt.legend()

plt.show()Note that all forecasts beyond one-step ahead forecast will all be the identical, namely a straight line in the blue shaded area.

Connections of AR and MA

We can show that any \(\text{AR(1)}\) can be rewritten as an \(\text{MA($\infty$)}\) model \[ \text{AR(1)}: \qquad Y_{t}=\phi_0+\phi_{1} Y_{t-1}+u_{t} \] Perform a recursive substitution \[\begin{align} Y_t &= \phi_0 + \phi_1(\phi_0 + \phi_1Y_{t-2}+u_{t-1})+u_t = \phi_0 + \phi_1\phi_0+\phi_1^2Y_{t-2}+\phi_1u_{t-1}+u_t\\ &= \phi_0 + \phi_1\phi_0+\phi_1^2(\phi_0+\phi_1Y_{t-3}+u_{t-2})+\phi_1u_{t-1}+u_t=\phi_0 + \phi_1\phi_0 +\phi_1^2\phi_0 +\phi_1^3Y_{t-3}+\phi_1^2u_{t-2}+\phi_1u_{t-1}+u_t\\ &\qquad\vdots\\ &=\frac{\phi_0}{1-\phi_1}+\sum_{i=0}^\infty\phi_1^iu_{t-1} \end{align}\] It holds because of the fact \[ \lim_{i\rightarrow\infty}\phi_1^iY_{t-i}=0, \qquad-1<\phi <1 \]

fig, ax = plt.subplots(nrows=2, ncols=1, figsize=(12, 8))

ar = np.array([1])

ma = np.array([0.8**i for i in range(100)])

mod_obj = ArmaProcess(ar, ma)

ma_sim = mod_obj.generate_sample(nsample=500)

g = plot_acf(

ma_sim, ax=ax[0], lags=100, title="$MA(\infty), \phi_i = .8^i, i\in \mathbb{Z}^+$"

)

ar = np.array([1, -0.8])

ma = np.array([1])

mod_obj = ArmaProcess(ar, ma)

ar_sim = mod_obj.generate_sample(nsample=500)

g = plot_acf(ar_sim, ax=ax[1], lags=100, title="$AR(1), \phi=.8$")ACF vs PACF

Before the discussion of \(\text{ARIMA}\) identification, we shall make some sense out of autocorrelation function (ACF) and partial autocorrelation function (PACF), which both are classical tools for identifying lags of \(\text{ARIMA}\).

We have shown that the formula of sample ACF \[ \rho_{k}=\frac{\operatorname{Cov}\left(r_{t}, r_{t-k}\right)}{\sqrt{\operatorname{Var}\left(r_{t}\right) \operatorname{Var}\left(r_{t-k}\right)}}=\frac{\operatorname{Cov}\left(r_{t}, r_{t-k}\right)}{\operatorname{Var}\left(r_{t}\right)}=\frac{\gamma_{k}}{\gamma_{0}} \]

However, PACF doesn’t have a formula.

Simply speaking, PACF requires removing all correlations in between. e.g. if you are measuring autocorrelation \(k\) periods apart, then all influences within the \(k\) should be eliminated.

One common way of evaluating PACF is to use demeaned regression \[ y_t-\bar{y}=\phi_{11} (y_{t-1}-\bar{y})+\phi_{22} (y_{t-2}-\bar{y})+\phi_{33} (y_{t-3}-\bar{y})+u_{t} \] Estimates of \(\phi_{kk}\) is the partial correlation at lag \(3\).

Partial autocorrelation function (PACF) is used for choosing the order of \(\text{AR}\) models, in contrast, ACF is for \(\text{MA}\) models.

ARMA and ARIMA

Finally, we join \(\text{AR}\) and \(\text{MA}\) models as \(\text{ARMA}\) or \(\text{ARMIA}\).

An \(\text{ARMA}(1,1)\) process is a straightforward combination of \(\text{AR}\) and \(\text{MA}\): \[ Y_{t}=\phi_0+\phi_{1} Y_{t-1}+\theta_{0} u_{t}+\theta_{1} u_{t-1} \]

In general, \(\text{ARMA}(p,q)\) process has the form $$ Y_t = 0 + {i=1}^p i Y{t-i}+_{i=1}^qi u{t-i}

In lag operator form \[ \begin{aligned} \left(1-\phi_1 L-\phi_2 L^2-\cdots\right.&\left.-\phi_p L^p\right) Y_t=\phi_0+\left(1+\theta_1 L+\theta_2 L^2+\cdots+\theta_q L^q\right) u_t . \end{aligned} \]

The lag operator form’s sign is the one that statsmodels using, i.e. reversing the signs of all \(\text{AR}\) terms.

And \(\text{ARIMA}\) model is essentially the same as \(\text{ARMA}\), it mean we have to difference a series \(d\) times to render it stationary before applying an \(\text{ARIMA}\) model, we say that the original time series is \(\text{ARIMA}(p,d,q)\) process.

By the same token, \(\text{ARIMA}(p,0,q)\) process is exactly the same as \(\text{ARMA}(p,q)\).

Features of ARMA

Take expectation of \((2)\) \[ \begin{align} E(Y_t) &= E(\phi_0) + \sum_{i=1}^p \phi_i E(Y_{t-i})+\sum_{i=1}^q\theta_i E(u_{t-i} )\\ \mu &= \phi_0 + \sum_{i=1}^p \phi_i \mu \qquad\longrightarrow \qquad \mu=\frac{\phi_0}{1- \sum_{i=1}^p \phi_i} \end{align} \]

which means stationarity of \(\text{ARMA}\) completely depends the parameters of \(\text{AR}\).

The demeaned form can lead us to autocovariance as shown previously

\[ \begin{aligned} Y_t-\mu=& \phi_1\left(Y_{t-1}-\mu\right)+\phi_2\left(Y_{t-2}-\mu\right)+\phi_p\left(Y_{t-p}-\mu\right)+\varepsilon_t+\theta_1 \varepsilon_{t-1}+\theta_2 \varepsilon_{t-2}+\cdots+\theta_q \varepsilon_{t-q} . \end{aligned} \]

Multiply both sides by \((Y_{t-j}-\mu)\) and take expectation, resulting equation takes the form \[ \gamma_j=\phi_1 \gamma_{j-1}+\phi_2 \gamma_{j-2}+\cdots+\phi_p \gamma_{j-p} \quad \text { for } j=q+1, q+2, \ldots \]

which means after lag \(q\), the autocovariance/autocorrelation function follows the \(p\)th order difference equation by the autoregressive parameters.

Box-Jenkins Methodology

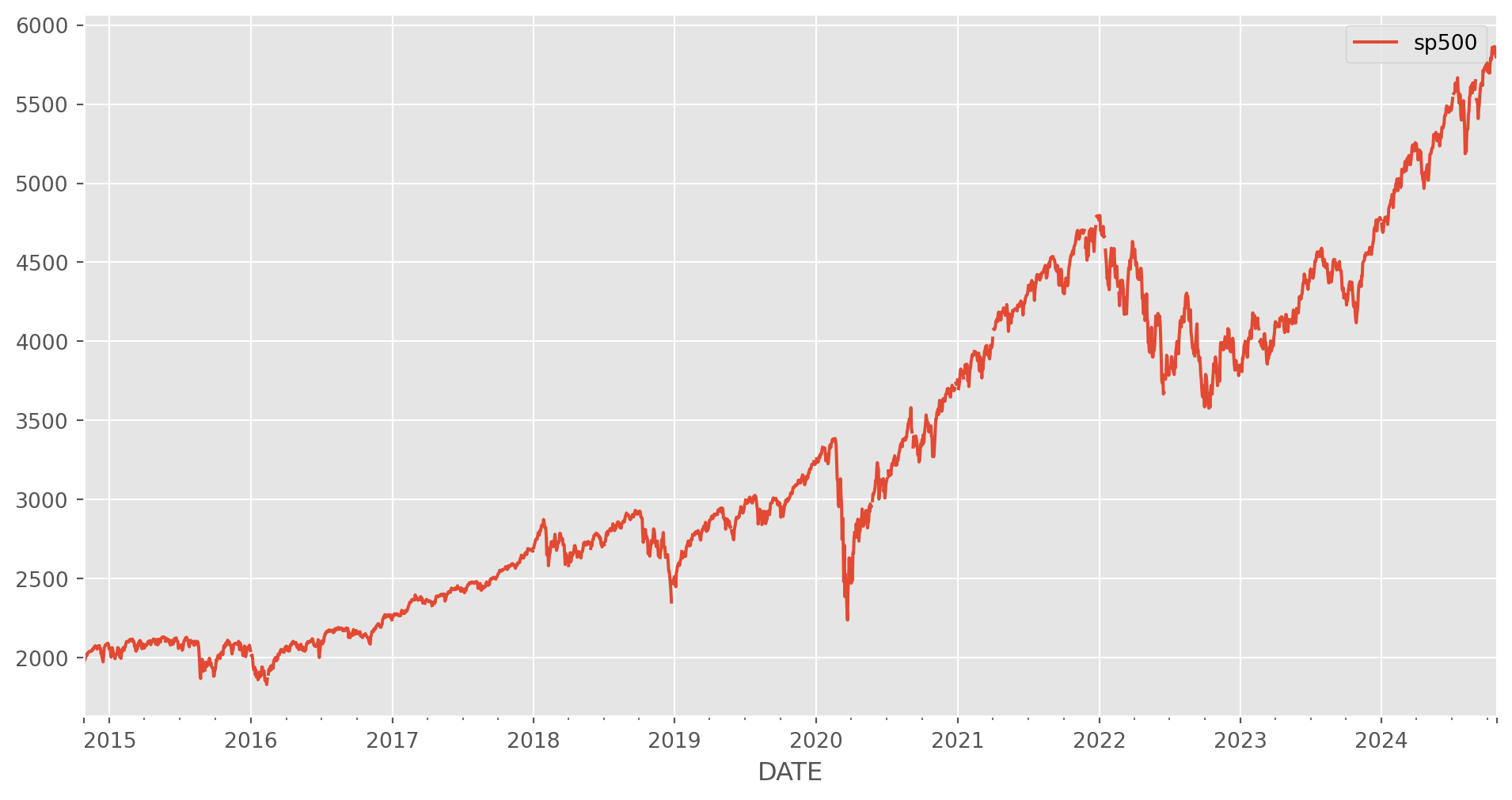

The pipeline of working through an \(\text{ARIMA}\) model from identification to forecasting is called Box-Jenkins Methodology which includes identification, estimation, diagnostics and forecasting.

As an example, let’s import an series from Fred. Needless to say it’s unstationary at first sight.

start = dt.datetime(2010, 1, 1)

end = dt.datetime.today() # the last time I run this file is in Oct 2022

df = data.DataReader(["sp500"], "fred", start, end)

df.plot(figsize=(12, 6))

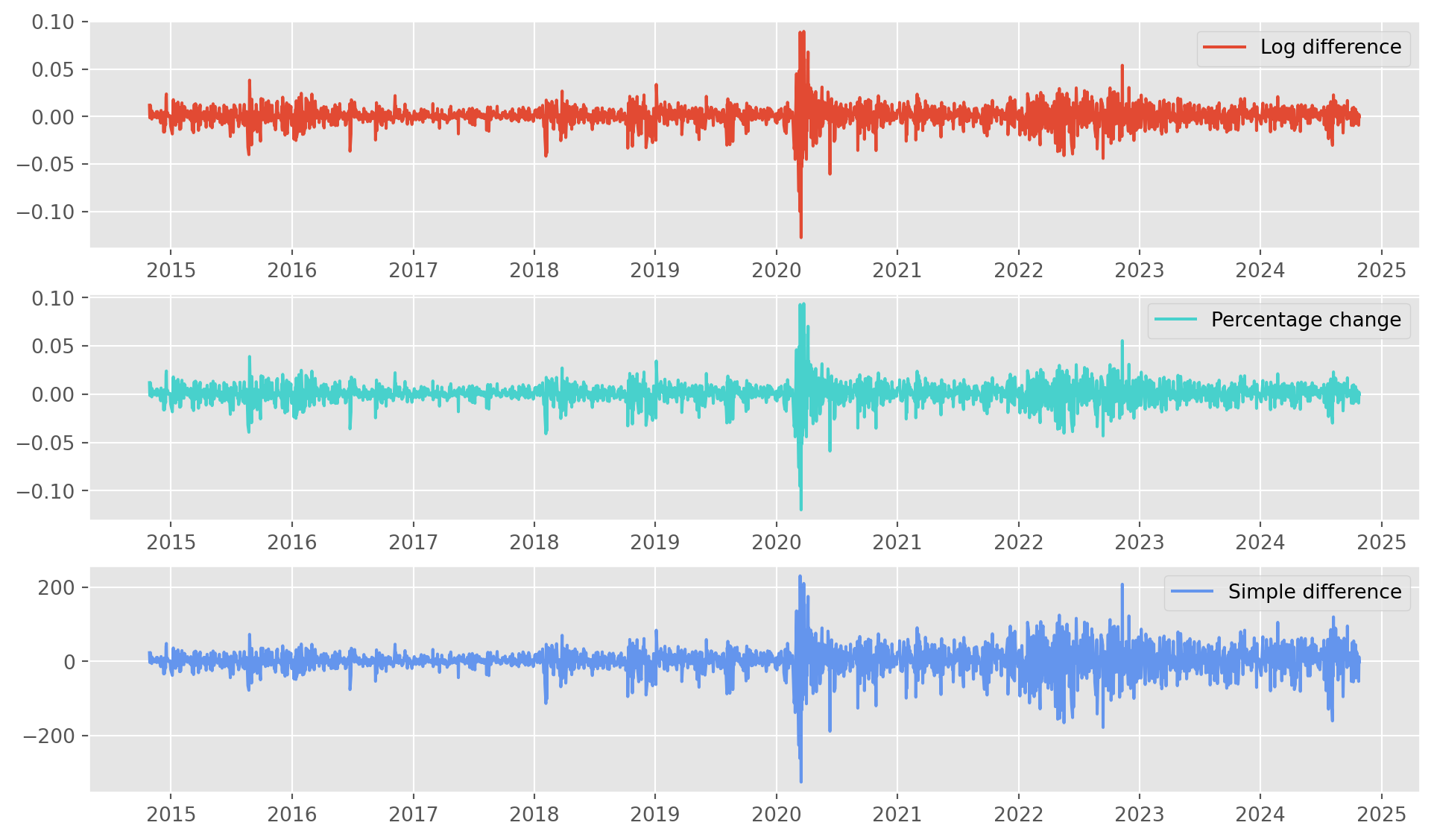

plt.show()As we have discussed, there are several methods to stationarize a series: log difference, percentage change and simple difference.

And remember that Box-Jenkins methodology requires stationary time series.

df["sp500_ln_diff"] = np.log(df) - np.log(df.shift()) # log differencea

df["sp500_pct"] = df["sp500"].pct_change() # percentage change

df["sp500_diff"] = df["sp500"].diff() # simply 1st order difference

df = df.dropna()The series with each method are plotted below, the third one, i.e. simple difference, shows heteroskedasticity to some extent in later period, financial series with simple difference commonly shows this feature, which is also the reason we rarely use simple difference on financial series.

The first two are similar, you choose anyone you see fit. However the industrial standard is log difference for its mathematical flexibility.

fig, ax = plt.subplots(figsize=(12, 7), nrows=3, ncols=1)

ax[0].plot(df["sp500_ln_diff"], label="Log difference")

ax[0].legend()

ax[1].plot(df["sp500_pct"], label="Percentage change", color="MediumTurquoise")

ax[1].legend()

ax[2].plot(df["sp500_diff"], label="Simple difference", color="CornflowerBlue")

ax[2].legend()

plt.show()Here is a technical issue highlighted, note below that freq=None, this could cause an error in the ARIMA instantiation.

df.indexDatetimeIndex(['2014-10-28', '2014-10-29', '2014-10-30', '2014-10-31',

'2014-11-03', '2014-11-04', '2014-11-05', '2014-11-06',

'2014-11-07', '2014-11-10',

...

'2024-10-14', '2024-10-15', '2024-10-16', '2024-10-17',

'2024-10-18', '2024-10-21', '2024-10-22', '2024-10-23',

'2024-10-24', '2024-10-25'],

dtype='datetime64[ns]', name='DATE', length=2423, freq=None)The solution is to explicitly define it as days D.

df.index = pd.DatetimeIndex(df.index).to_period("D")Now the index is explicitly labeled as days.

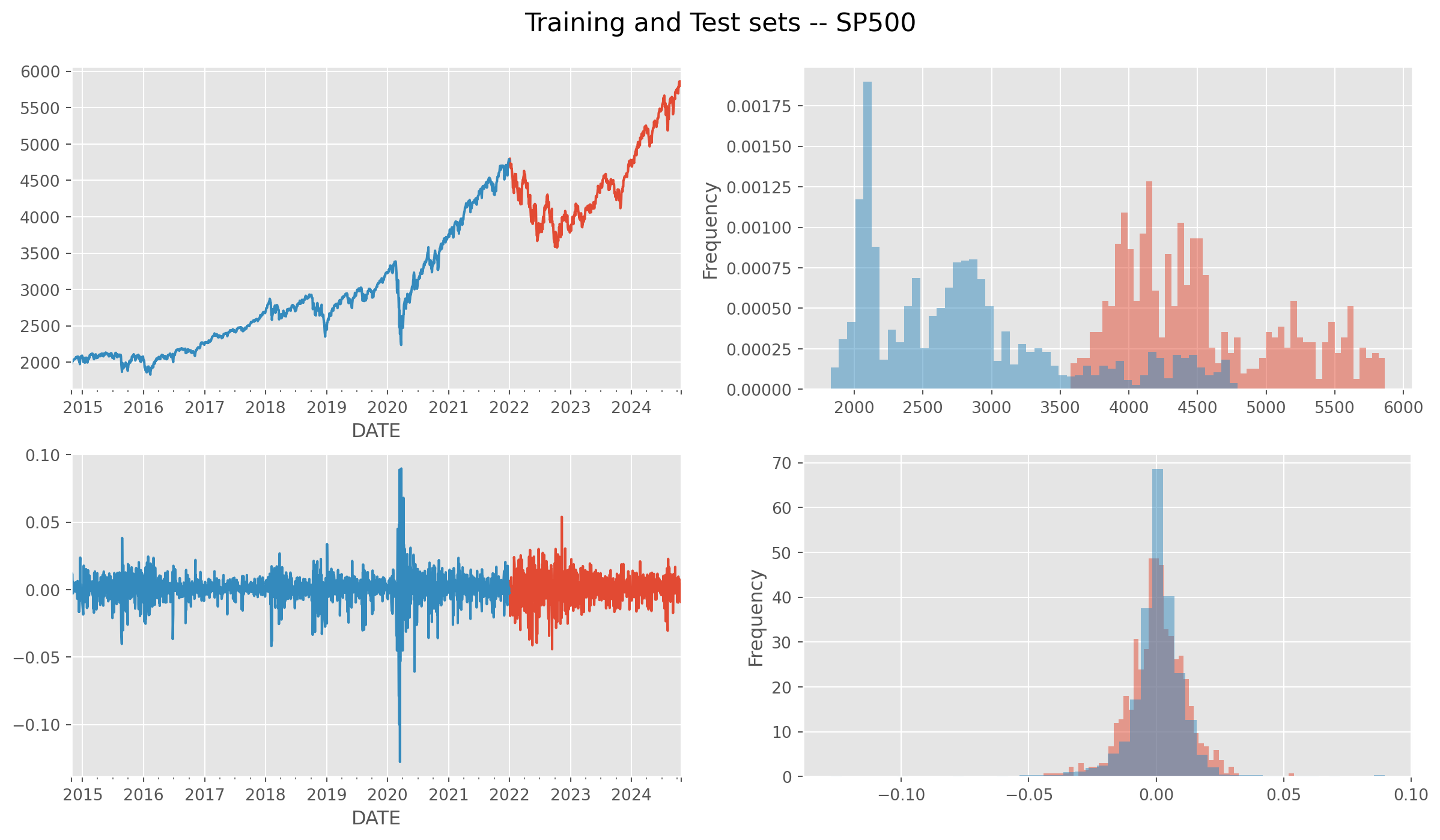

Also divide them into training and test sets.

df_train = df.loc[:"2021"]

df_test = df.loc["2022":]

fig, ax = plt.subplots(figsize=(15, 8), nrows=2, ncols=2)

df_test["sp500"].plot(ax=ax[0, 0])

df_train["sp500"].plot(ax=ax[0, 0])

df_test["sp500"].plot.hist(ax=ax[0, 1], bins=50, alpha=0.5, density=True)

df_train["sp500"].plot.hist(ax=ax[0, 1], bins=50, alpha=0.5, density=True)

df_test["sp500_ln_diff"].plot(ax=ax[1, 0])

df_train["sp500_ln_diff"].plot(ax=ax[1, 0])

df_test["sp500_ln_diff"].plot.hist(ax=ax[1, 1], bins=50, alpha=0.5, density=True)

df_train["sp500_ln_diff"].plot.hist(ax=ax[1, 1], bins=50, alpha=0.5, density=True)

plt.suptitle("Training and Test sets -- SP500", size=16, y=0.94)

plt.show()Identification

Correlograms of ACF and PACF are shown as below.

fig, ax = plt.subplots(nrows=2, ncols=1, figsize=(12, 7))

g1 = plot_pacf(df_train["sp500_ln_diff"], ax=ax[0], method="ywm", zero=False)

g2 = plot_acf(df_train["sp500_ln_diff"], ax=ax[1], zero=False)As identification shows, it actually suggests 2nd orders for both \(\text{AR}\) and \(\text{MA}\).

Estimation

Of course you can use statsmodels to estimate the model with the orders suggested by correlograms, another option is pmdarima library, it automatically performs a grid search of \(\text{ARIMA}\) orders.

You can specify the \(p\), \(d\) and \(q\) for \(\text{ARIMA}\), or give a range, or even left them out to default values. If anything unclear, run pm.auto_arima?.

results1 = pm.auto_arima(

df_train["sp500_ln_diff"],

start_p=1,

start_q=1,

max_p=5,

max_q=5,

trace=True,

information_criterion="bic", # default is AIC

error_action="ignore", # don't want to know if an order does not work

suppress_warnings=True, # don't want convergence warnings

stepwise=True,

) # set to stepwisePerforming stepwise search to minimize bic

ARIMA(1,0,1)(0,0,0)[0] intercept : BIC=-10710.017, Time=0.20 sec

ARIMA(0,0,0)(0,0,0)[0] intercept : BIC=-10661.174, Time=0.17 sec

ARIMA(1,0,0)(0,0,0)[0] intercept : BIC=-10709.733, Time=0.12 sec

ARIMA(0,0,1)(0,0,0)[0] intercept : BIC=-10699.490, Time=0.33 sec

ARIMA(0,0,0)(0,0,0)[0] : BIC=-10665.229, Time=0.19 sec

ARIMA(2,0,1)(0,0,0)[0] intercept : BIC=-10708.847, Time=0.48 sec

ARIMA(1,0,2)(0,0,0)[0] intercept : BIC=-10710.336, Time=0.91 sec

ARIMA(0,0,2)(0,0,0)[0] intercept : BIC=-10717.924, Time=0.82 sec

ARIMA(0,0,3)(0,0,0)[0] intercept : BIC=-10711.926, Time=0.77 sec

ARIMA(1,0,3)(0,0,0)[0] intercept : BIC=-10704.239, Time=1.33 sec

ARIMA(0,0,2)(0,0,0)[0] : BIC=-10721.724, Time=0.28 sec

ARIMA(0,0,1)(0,0,0)[0] : BIC=-10702.152, Time=0.15 sec

ARIMA(1,0,2)(0,0,0)[0] : BIC=-10713.946, Time=0.27 sec

ARIMA(0,0,3)(0,0,0)[0] : BIC=-10715.376, Time=0.45 sec

ARIMA(1,0,1)(0,0,0)[0] : BIC=-10712.859, Time=0.12 sec

ARIMA(1,0,3)(0,0,0)[0] : BIC=-10707.726, Time=0.58 sec

Best model: ARIMA(0,0,2)(0,0,0)[0]

Total fit time: 7.167 secondsHowever \(\text{BIC}\) suggests order \((0, 0, 2)\). To print the estimation results, use the summary() method.

print(results1.summary()) SARIMAX Results

==============================================================================

Dep. Variable: y No. Observations: 1742

Model: SARIMAX(0, 0, 2) Log Likelihood 5372.056

Date: Sun, 27 Oct 2024 AIC -10738.112

Time: 17:40:23 BIC -10721.724

Sample: 10-28-2014 HQIC -10732.053

- 12-31-2021

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ma.L1 -0.1559 0.009 -17.702 0.000 -0.173 -0.139

ma.L2 0.1279 0.008 16.327 0.000 0.113 0.143

sigma2 0.0001 1.42e-06 86.533 0.000 0.000 0.000

===================================================================================

Ljung-Box (L1) (Q): 0.06 Jarque-Bera (JB): 22147.38

Prob(Q): 0.80 Prob(JB): 0.00

Heteroskedasticity (H): 2.77 Skew: -1.08

Prob(H) (two-sided): 0.00 Kurtosis: 20.33

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).However, if you believe you can find a better order, feel free to use ARIMA class directly.

Instantiate a \(\text{ARIMA}\) object with order \((3, 0, 2)\).

mod_obj_2 = ARIMA(df_train["sp500_ln_diff"], order=(3, 0, 2))

results2 = mod_obj_2.fit()

print(results2.summary()) SARIMAX Results

==============================================================================

Dep. Variable: sp500_ln_diff No. Observations: 1742

Model: ARIMA(3, 0, 2) Log Likelihood 5392.632

Date: Sun, 27 Oct 2024 AIC -10771.264

Time: 17:40:25 BIC -10733.025

Sample: 10-28-2014 HQIC -10757.125

- 12-31-2021

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 0.0005 0.000 1.597 0.110 -0.000 0.001

ar.L1 -0.8221 0.072 -11.357 0.000 -0.964 -0.680

ar.L2 0.1596 0.075 2.125 0.034 0.012 0.307

ar.L3 0.1798 0.015 12.039 0.000 0.151 0.209

ma.L1 0.6795 0.075 9.043 0.000 0.532 0.827

ma.L2 -0.1749 0.067 -2.622 0.009 -0.306 -0.044

sigma2 0.0001 1.75e-06 68.527 0.000 0.000 0.000

===================================================================================

Ljung-Box (L1) (Q): 0.08 Jarque-Bera (JB): 13554.44

Prob(Q): 0.78 Prob(JB): 0.00

Heteroskedasticity (H): 2.54 Skew: -1.07

Prob(H) (two-sided): 0.00 Kurtosis: 16.50

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).Almost all p-values shows the significance, therefore it could be an alternative model to the previous one.

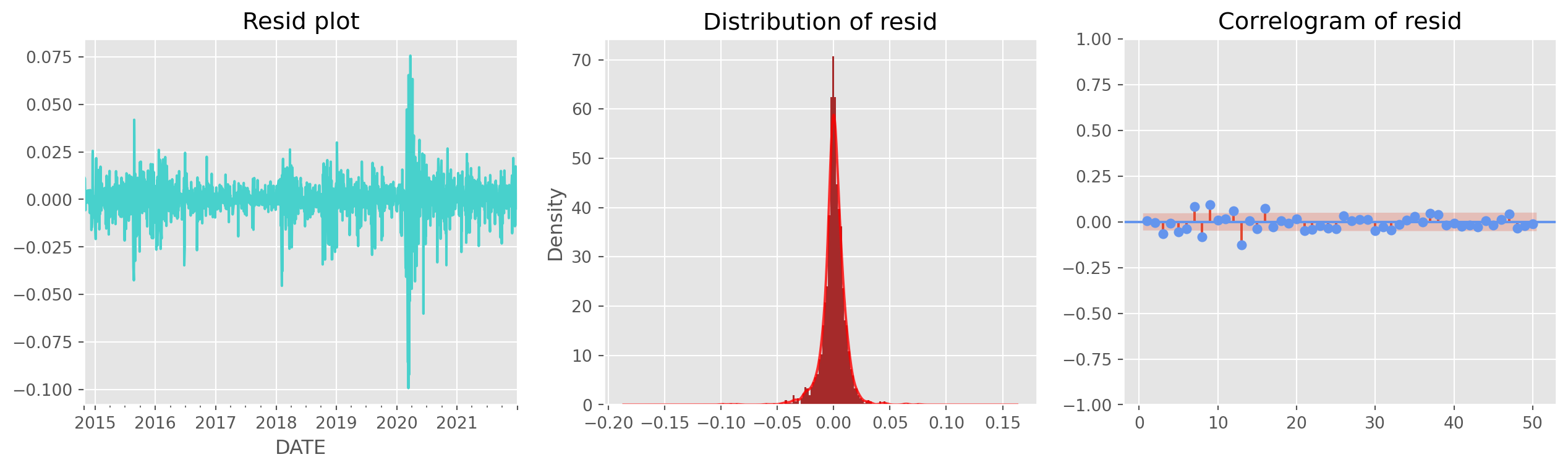

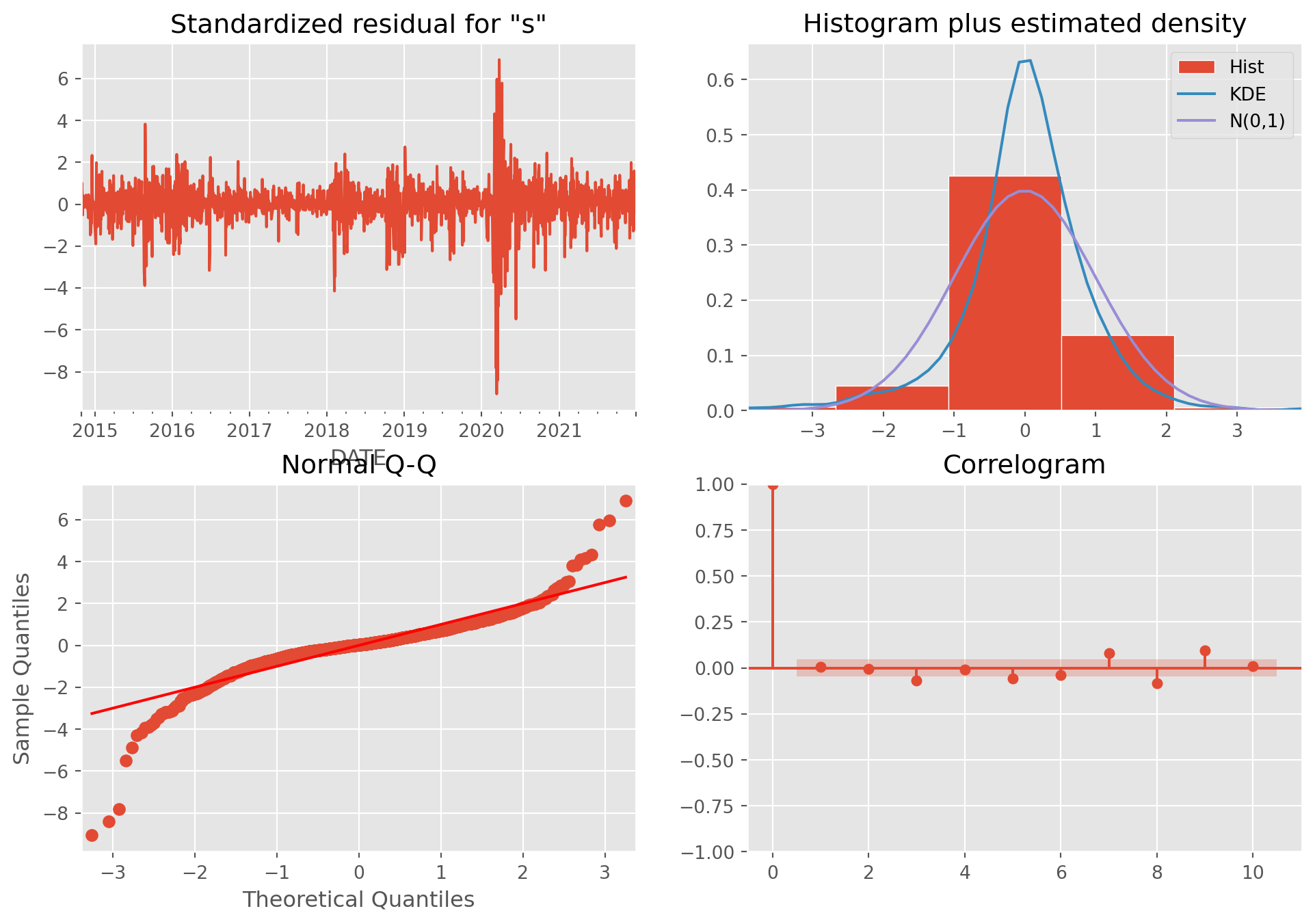

Diagnostics of Residuals

All you need to care is that whether the residuals are generated from an white noise stochastic process.

def resid_diagnostics(resid):

fig, ax = plt.subplots(figsize=(16, 4), nrows=1, ncols=3)

resid.plot(ax=ax[0], title="Resid plot", color="MediumTurquoise")

resid.plot.hist(ax=ax[1], density=True, bins=100, color="Brown")

resid.plot.kde(ax=ax[1], alpha=0.8, color="red", title="Distribution of resid")

g = plot_acf(

resid,

ax=ax[2],

lags=50,

title="Correlogram of resid",

zero=False,

color="CornflowerBlue",

)

plt.show()You can use the stylized residual diagnostics from statsmodels, a bit overkill though.

Not perfectly white noise, but we can live with that.